2025 Coverdell Contribution Limits - 2025 HSA Contribution Limits Claremont Insurance Services, The contribution limit is lower for higher earners and is phased out for single taxpayers with an agi of $110,000 or more and for joint filers with an agi of $220,000 or more. Limit for each designated beneficiary. Carnegie Hall January 2025. On january 28 last year at carnegie hall, yuja wang played […]

2025 HSA Contribution Limits Claremont Insurance Services, The contribution limit is lower for higher earners and is phased out for single taxpayers with an agi of $110,000 or more and for joint filers with an agi of $220,000 or more. Limit for each designated beneficiary.

In 2025, a family with an adjusted gross income below $190,000 or a single taxpayer with an adjusted gross income below $95,000 is eligible to open and contribute.

The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808. The $2,000 contribution limit for each contributor is phased out based on the contributor’s income.

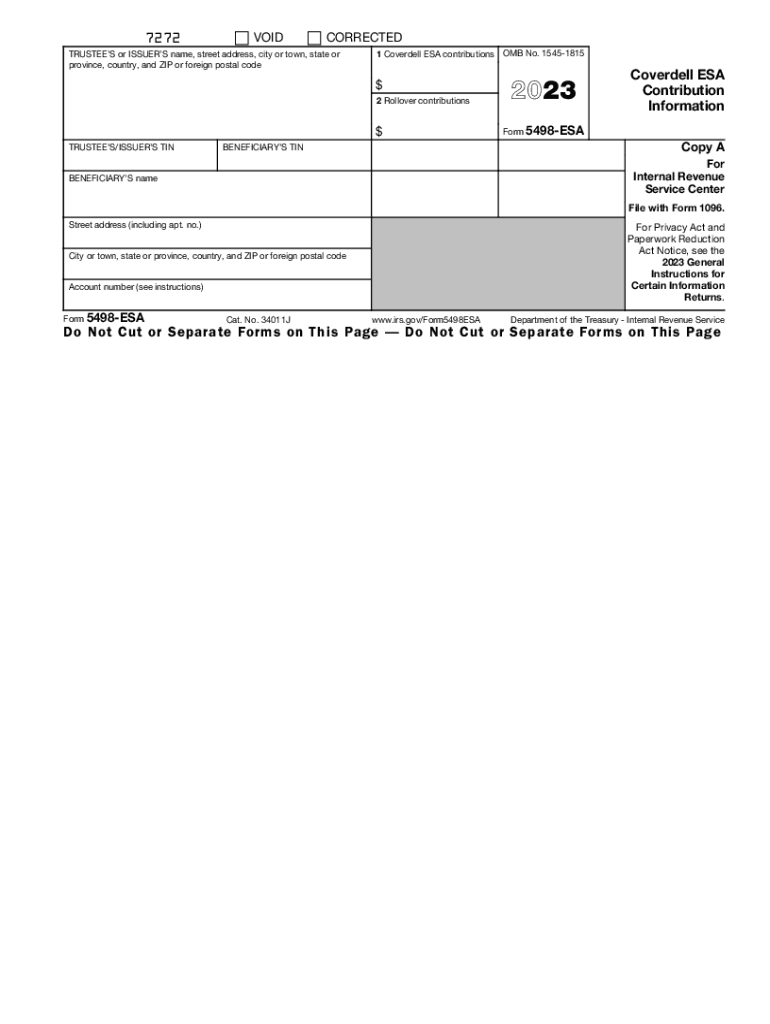

Coverdell ESA Contribution Information Do Not Cut or Fill Out and, In addition to the modified adjusted gross income limits, there are a number of rules you need to keep in mind while putting money into and taking money out of a. Employer plans will receive an increase in contribution limits as well.

2025 Kia Ev6 Lease. According to bulletins sent to dealers last week, 2025 kia ev6 […]

The simple ira (savings incentive match plan for employees) will receive a.

美国教育基金【2025】Coverdell ESA、529计划详解 • 美国生活指南, The coverdell esa contribution limits are $2,000 annually. You can possibly save more for retirement in 2025, thanks to recent irs changes to employee contribution limits for 401 (k), 403 (b), and most 457 plans.

2025 Contribution Limits for Retirement Plans — Sandbox Financial Partners, In addition to the modified adjusted gross income limits, there are a number of rules you need to keep in mind while putting money into and taking money out of a. The simple ira (savings incentive match plan for employees) will receive a.

Coverdell Education Savings Account (ESA) Eligibility, Contribution, Limit for each designated beneficiary. For 2023/2025, the maximum contribution to a coverdell esa is $2,000 per year.

Does Employer Contribution Count Towards Limit AMARYSUMAA, Deadline to make a contribution for 2023 tax year is april 15, 2025. Contributions must be made in cash, and they're notdeductible.

Rules for contributions to a coverdell education savings account.